Parcel tax proposal approved

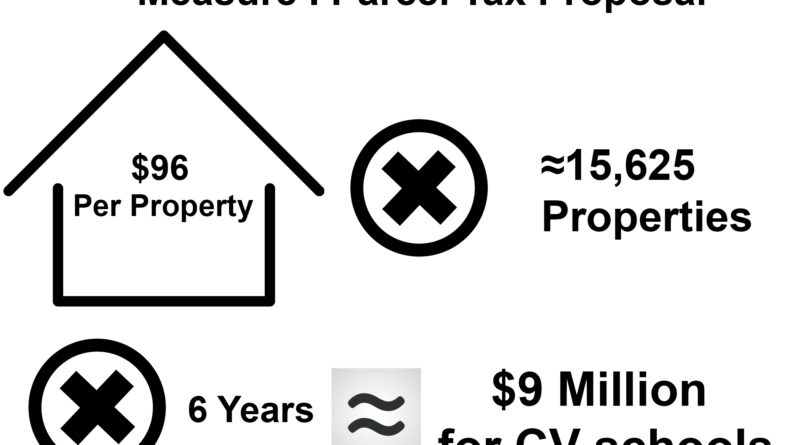

The CVUSD school board unanimously approved a parcel tax proposal on Nov. 12. Castro Valley voters will get to decide on Measure I on the March 3 ballot.

If passed, the tax is expected to raise $1.5 million annually for six years. The money raised by the parcel tax will be used for a variety of educational needs, such as computer repairs and hiring more custodians, but it will specifically give Castro Valley teachers pay raises.

“I have seen many of my colleagues leave for other districts, whether they are seeking higher pay, or more benefits, or better working conditions. Living in the Bay Area on a teacher’s salary is difficult, and every year there are open science positions that are hard to fill with quality teachers,” Lauren Baiocchi told the board.

Baiocchi was one of several teachers, parents, and a student urging the school board to vote for the parcel tax proposal.

If Castro Valley residents vote for the parcel tax, every homeowner in Castro Valley will pay an additional $96 per property, effective July 21, 2020.

Some Castro Valley residents may confuse the parcel tax with the Measure G bond passed in 2016. A parcel tax is a set real estate fee, but a bond is based on property value.

The Measure G bond was to raise an estimated $123 million. According to Ballot Pedia, the additional property tax as a result of the bond was to be around “$60 per $100,000 of the assessed property value” and “restricts the use of the proceeds from the bond sale to items such as building school buildings, improving school grounds, supplying school buildings and grounds with equipment, and the acquisition of real property for school facilities.” The construction going on right now at CVHS is a result of Measure G.

These restrictions would not apply to the parcel tax. Many towns around Castro Valley already have a parcel tax. In 2018, the San Lorenzo Unified School District, San Leandro Unified School District, Martinez Unified School District, and many more school districts in California approved parcel taxes.

CVHS social studies teacher Ian Rodriquez explained many teachers feel they are spread too thin and are given many extra duties without extra pay.

“These solutions [parcel taxes] have been implemented in neighboring districts,” said Rodriquez.

A parcel tax is much harder to get approved than a bond, because it needs a two-thirds majority to pass, compared to the 55 percent majority needed to pass a bond. Because of this, teachers and parents present at the board meeting promised to go out and campaign to get the parcel tax to pass.

“It’s going to take a lot of time and effort to spread the word to the Castro Valley community about the importance of the passage of this parcel tax,” said Rodriquez.

One parent said she would go door to door to inform and persuade people to vote for the parcel tax.

“The parcel tax will help our students and staff,” said Mark Mladinich, a CVHS history teacher and president of Castro Valley Teachers Association.