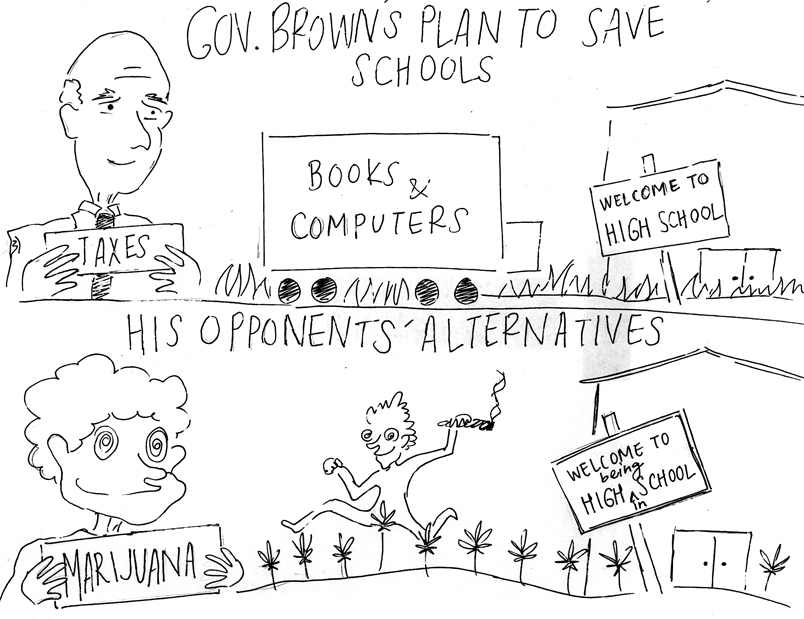

Brown’s budget proposal “the best solution,” we say

As a result of the poor U.S. economy that has led to numerous cuts throughout the state of California, Governor Jerry Brown recently proposed a tax plan involving $7 billion tax hike from 2012 to 2017 to help relieve the $371 billion state deficit. Those who earn more than $250,000 every year would have a one percent tax increase, $300,000-$500,000 per year a 1.5 percent tax increase, and more than $500,000 per year a two percent tax increase. Everyone will also pay an additional half-cent in sales tax.

“Without new tax revenue, we will have no other choice than to make deeper and more damaging cuts to schools, universities, public safety, and our courts,” Brown said.

The Olympian supports Brown’s tax plan. Nobody likes raising taxes (after all, everyone likes to have more money), but it’s necessary. Ultimately, there are two choices: cuts or tax increases.

Those who are rich would be able to pay the additional one to two percent. Some people may say that that isn’t fair if only the wealthy are taxed more. However, some people make barely enough to eat and pay rent. If income taxes were raised for everyone, these people wouldn’t be able to eat or have shelter. Also, the half-cent sales tax affects everybody, which makes Brown’s proposal more fair.

People who disagree with Brown’s proposal say that the wealthy work hard to earn their money and deserve to keep it. Although this is true, if they do not pay more taxes and more cuts are made, they too will eventually suffer. For example, when they are old and need to go a hospital, they want the doctors there to know what they are doing and not using Google to learn things like “how to do hip surgery” or “how do you perform heart surgery?” They would want architects that design strong, safe buildings to live and work in. By paying taxes, they not only help others, they help themselves now and later.

Everyone wants their children to succeed, to be able to go to school, to learn, and to obtain the knowledge needed to reach their dreams. Millions of kids rely on the public school system. If cuts are continuously made to education, schools would not have enough money to provide their students with the materials they need to learn. Eventually, some schools may be forced to close, creating larger class sizes in other schools.

Others may suggest making money elsewhere, like by legalizing marijuana. However, this change will have very harmful effects. True, the taxes from marijuana would help the state budget, but more people would be able to easily obtain and use it, including teenagers and young children.

Some people may argue that if the wealthy are taxed more, they won’t be able to provide job opportunities. More people would be unemployed. However, the tax increase is not that much; corporations should still be able to hire people. Rather than helping just a few families, the taxes paid would go to areas like public safety and education, which will help thousands of people throughout the state.

Brown’s proposal is the best solution for California’s budget crisis. It has the potential to yield good results without having many harmful effects. Voters will decide its fate during the election occurring later on this year. We at The Olympian agree with it, and hope voters do too so the proposal can be initiated. Hopefully, it will alleviate the state’s agonizing budget crisis.